You may already have great bookkeeping…

But we want to make it as easy as possible for our artists to be on top of their earnings and outgoings, especially for first-time Supporting Artists, many of whom have never been self-employed before.

As a Supporting Artiste, you are considered Self-Employed and it is your responsibility to fill in your own tax self-assessment with HMRC each year.

This requires you to keep a record of your income and expenses so HMRC can accurately calculate how much tax you owe.

But don’t wait until the Self-Assessment deadline to start tracking your earnings!

If you don’t already have an income spreadsheet, feel free to download your own template from the button below:

The rest of this blog will be dedicated to explaining how to use this spreadsheet effectively.

This blog is full of explanations and examples so we really recommend exploring this spreadsheet properly on a desktop computer or laptop when you have a moment to sit down.

This spreadsheet is just a template.

To save your own spreadsheet to your own Google sheets, click “File” and then “Make a copy”.

You can then rename this copied file to something more appropriate, like “Income 2024-25”

Upon opening the file, you will be greeted with the main Summary page of the spreadsheet.

This summary page gives you everything you need to know at a quick glance, including monthly taxable and non-taxable income, business expenses, and tax deductibles.

If you scroll down, you will find your annual totals for earnings, expenses and taxable income.

All of these figures will update automatically as you fill in each month’s earnings.

Each month has it’s own page, which can be found at the bottom of the window. Let’s open April.

Above is what a blank month looks like.

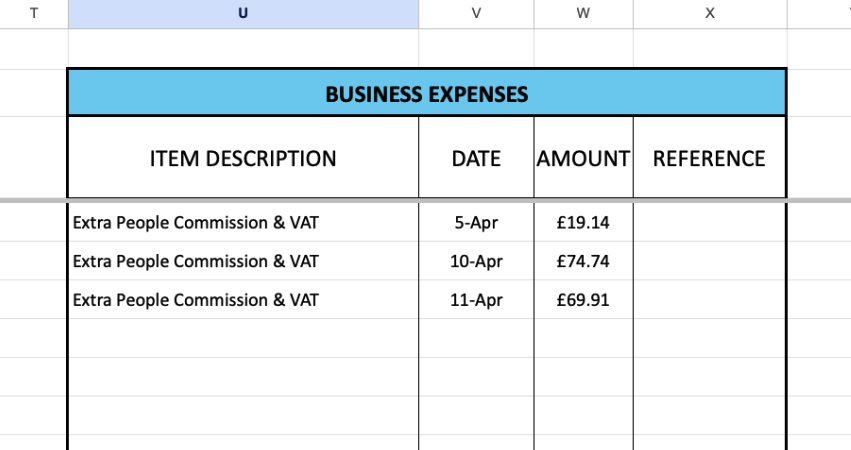

If you scroll to the right, you will also find columns for Tax Deductibles and Business Expenses, as seen below.

But first, let’s turn back to income.

We recommend dedicating an income column to each agency that you do jobs through, especially as different agencies have different commission rates.

This will enable you to see at a glance how much you’ve earned from each agency each month.

We’ve left two columns for other income streams, as we know many SA’s don’t solely rely on background work for income. To delete or add more income columns, simply right click the top of each column and select from the drop down menu.

Now let’s start inputting some earnings.

Firstly, you should decide if you would like to input your earnings before OR after agency commission is deducted from your wages. Your taxable income will be the same whichever you chose.

If you input your income before agency commission is deducted, be sure to record the agency commission under Businesses Expenses so you are not taxed on this amount.

For example:

Instead, if you input your income after agency commission and VAT is deducted, (i.e. solely your take-home pay) you do not record agency commission and VAT as business expenses, or anywhere else for that matter.

Here is what those exact same days will look like after agency commission and VAT is removed:

Extra People’s commission is 20% plus VAT, which means 24% will be deducted before your wages land in your bank account via direct bank transfer.

To quickly calculate your take-home pay for Extra People jobs, multiply your pay total by 0.76.

For example, if your chit summarises your earnings as £250, the money that you will actually receive would be £190. (£250 x 0.76 = £190)

Always be sure to double check your earnings against the remittances on your online profile once they’re published.

Reminder: For income earned through other agencies with different commission rates, be sure to calculate your take-home pay accordingly.

Recording your earning after these deductions is faster, and gives a clearer image of your actual take-home pay on the spreadsheet.

Regardless of which method you choose, your taxable earnings will be the same. Whichever approach you decide, keep it the same consistently throughout the year.

The reason why someone may want to record agency commission and VAT is because they are VAT-registered and are able to claim back VAT expenses from the government.

As it is uncommon for SAs to be VAT registered, let’s continue to input earnings after the deductions.

When you come to input your actual earnings, you would use the code names for each project, such as Red Gun, Pilgrim or Gershwin.

You don’t need to use the £ symbol for your entries, simply enter the number and the £ will automatically appear.

Similarly, you don’t need to type out the full date. In the above image, “05/04” or “05-04” has auto-corrected to “5 Apr 2024”.

TIP: Once you recieve payment for each job, highlight the cell green so you can see at a glance what you’ve been paid for and what you haven’t.

If I’m not putting Agency Commission into the Business Expenses, what else am I putting in there?

Other Business Expenses that you can claim throughout your Supporting Artiste work can include:

Agency annual bookfees or subscriptions

Note: Extra People does not charge any admin, book or subscription fee

DBS Certificate costs

Union fees

Accomodation costs

Travel expenses such as

Train tickets

ULEZ and Congestion Charge fees

Parking Costs

Ubers & Taxi fares

Any food and drink that you had to purchase while travelling between or engaging in work engagements.

Grabbed lunch between a morning fitting and an afternoon fitting? That’s a business expense!

Any accessories for business management or to survive long days in crowd holding, such as

Work Diary/Calendar

Stationary

Water Bottle

Coffee Flask

Reusable Cutlery

Any self-investment for this line of work, including

Professional Headshots

Costume purchases

Hair and Make-Up products

Camera equipment for photos and self-tapes

Tripods & Stands

Lighting such as Ring Lights

Video-editing apps

Drivers reading this may have noticed that we haven’t mentioned fuel costs.

This is because there are two ways HMRC allows you to claim motor expenses against your profits.

Your total motor-related costs in the year and deduct the percentage that relates to your personal use.

Allowable motor expenses include:

Fuel

Repairs & maintenance

Road tax

Insurance

MOT

Parking

This method generally works best when you have little personal use on the vehicle.

This method also takes more organisation, as it requires you to keep all motor-related receipts as well as a mileage log, so you can work out the correct “business : personal” percentage for your tax return.

Calculate your business mileage and multiply it by the government allowance per mile.

For 2024-25 tax year, the allowance is as follows:

For Petrol & Diesel Cars:

£0.45 per mile for the first 10,000 miles

£0.25 for any additional mile after that

For Electric Cars

£0.45 per mile for the first 10,000 miles

£0.45 for any additional mile after that

Motorcycles have a flat rate of £0.24 per mile

For use of a bicycle you can claim £0.20 per mile

This method is easier to administer, as whilst you still need to keep an accurate mileage log, you don’t need to keep any receipts at all regarding your actual motor expenses.

This is the most common method used amongst Supporting Artists, as Film & TV work is mileage-intensive and this method makes calculating motor expenses easy.

Using this method, you are not able to claim for any additional motor costs, as the mileage rate is designed to take into account everything. You cannot claim for mileage and motor expenses. It’s an either/or scenario. Once you start using the mileage allowance for your vehicle in your HMRC self-assessment, you cannot change your approach until you start using a new vehicle.

Let’s demonstrate how you can record your mileage on the spreadsheet, using the Tax Deductibles section.

Your mileage inputs are on the same row as each job entry, so you don’t need to input the date and job again. Simply scroll to the right to find each job’s mileage and business expenses.

When you come to input your mileage, we recommend using exact postcodes of both your start and end points - many crowd bases and filming locations are in the middle of nowhere!

Either you can record your vehicle’s odometer after every business-related journey, or you can calculate your mileage using Google Maps or a similar application.

Note: Don’t forget to record the mileage of the return journey too and combine them for the day’s total mileage!

You may have spotted the column titled, “Hours worked at home”. This is irrelevant for SA work, and is more of a general self-employment column that may come in handy for your other income streams, designed for those that want to claim a portion of their home’s utility bills as a business expense. If you would like to learn more about doing this, you can do so here.

How to find the mileage between two locations using directions on Google Maps. If your journey differs from the one Google Maps produces, you can drag and drop the blue line on the map to reflect the roads you actually took. The mileage will automatically update to reflect your changes.

Now lets scroll to the bottom of the April page and see how our entries have changed things.

From those few entries, we now have exact totals of how much we’ve earned from each agency, the combined monthly income so far and total mileage incurred.

If we had put in any business expenses, our net income would be lower to reflect this.

But it gets better, because now let’s go back to the Summary Page using the tabs at the bottom of the window.

The Summary page has automatically updated to reflect our entries in April!

As the year progresses, you will quickly be able to discern and compare income month to month and track total taxable income in the run up to your self-assessment.

We hope this blog has given you the tools to track your earnings and outgoings better moving forward.

If you find yourself asking whether you should trade as a Sole Trader or using a Limited Company, being a Sole Trader makes the most sense for Supporting Artiste work and is much easier to set up and operate. We have made our recommendations on the assumption that you are registered as a Sole Trader.

If you haven’t already, you can register for Self-Assessment HERE - click “Register for Self-Assessment” about a 1/3 down the page.

Disclosure

The content and materials featured or linked to on Extra People blogs are for your information and education only and are not made to address your particular personal requirements.

This information does not constitute financial advice or recommendation and should not be considered as such. Extra People is not regulated by the Financial Conduct Authority (FCA), its authors are not financial advisors and it is therefore not authorised to offer financial advice.

The email address to use for any profile-related issue is epcommunity@extra-people.com

If you have any pay queries please contact artistsupport@wegotpop.com

If you have any booking enquiries please contact the booker you were contacted by on their email address, or reply to the last email concerning that project. Your email will go to a dedicated email for that production.

If you have general enquiries that are not pay or booking related, please contact team@extra-people.com

If you haven’t already, be sure to sign up to the Advice Centre newsletter below to be notified when we release new blogs.

All the best,

Extra People.